Cash Flow Analysis

Zakat & Tax Planning

Risk Management

Retirement Planning

Wealth Accumulation

Inheritance Planning

+

+

+

An Islamic Financial Adviser (IFA) is a company approved by Bank Negara Malaysia (BNM) under the IFSA to carry out Islamic financial advisory business.

An Islamic Financial Adviser’s Representative (IFAR) means an individual, however styled, in the direct employment of, acting for or by arrangement with an approved IFA, who performs for the IFA any services relating to Islamic financial advisory business.

Establish Client-Planner Relationship

Begin by defining the financial planner’s role, setting expectations, and outlining services. This step builds trust and understanding.

Gather Client Data and Set Goals

Collect information about the client’s financial situation, including income, expenses, assets, liabilities, and financial goals. This is essential for creating a tailored plan.

Analyze and Evaluate Financial Status

Assess the client’s current financial position based on the data collected. Identify any gaps in savings, investments, insurance, or retirement planning.

Develop and Present Financial Plan

Create a personalized financial plan that addresses the client’s goals and needs, complete with strategies for budgeting, investing, risk management, and tax planning.

Implement the Financial Plan

Put the plan into action, coordinating with other financial professionals if needed (e.g., investment managers, insurance agents).

Monitor and Review Progress

Regularly review and update the plan to keep it aligned with any changes in the client’s life, goals, or financial situation.

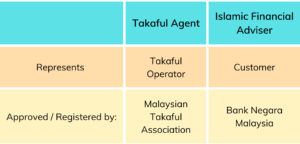

An IFA is an independent party that provides financial advisor services to the customer based on the customer’s financial needs. Therefore, the IFA sources for Takaful plans from multiple Takaful operators that best suit your needs.

A Takaful agent represents its principal Takaful operator and primarily offer Takaful plans issued by the Takaful operator it represents.

These differences are illustrated in the table below:

You may check a person's license under Bank Negara Malaysia (BNM) by clicking at the link below:

https://www.bnm.gov.my/regulations/fsp-directory/far

A company licensed under Securities Commission (SC) that provides comprehensive financial advice and services to individuals and organizations, helping them manage their finances and achieve their financial goals.

A Financial Planner Representative (FPR) is a licensed individual under a Financial Planning Firm who helps clients with full financial planning – including budgeting, protection, investment, retirement & estate planning – based on clients' goals.

Establish Client-Planner Relationship

Begin by defining the financial planner’s role, setting expectations, and outlining services. This step builds trust and understanding.

Gather Client Data and Set Goals

Collect information about the client’s financial situation, including income, expenses, assets, liabilities, and financial goals. This is essential for creating a tailored plan.

Analyze and Evaluate Financial Status

Assess the client’s current financial position based on the data collected. Identify any gaps in savings, investments, insurance, or retirement planning.

Develop and Present Financial Plan

Create a personalized financial plan that addresses the client’s goals and needs, complete with strategies for budgeting, investing, risk management, and tax planning.

Implement the Financial Plan

Put the plan into action, coordinating with other financial professionals if needed (e.g., investment managers, insurance agents).

Monitor and Review Progress

Regularly review and update the plan to keep it aligned with any changes in the client’s life, goals, or financial situation.

FPR can provide advice on a wide range of financial solutions – including unit trust, PRS, takaful/insurance, investment planning, retirement, and estate planning. Their focus is on holistic financial planning, with Shariah-compliant aspect.

iFAR, on the other hand, specialise in takaful. iFAR can compare takaful plans from multiple providers to recommend the best fit for the client.

In short:

FPR = Broader financial planning scope, regulated by SC.

iFAR = Specialised in Takaful, regulated by BNM.

Both roles work together to help clients achieve their financial goals in a trusted and compliant manner.

You may check a person's license under Securities Commission (SC) by clicking at the link below:

https://easy.seccom.com.my:8222/